arkansas estate tax return

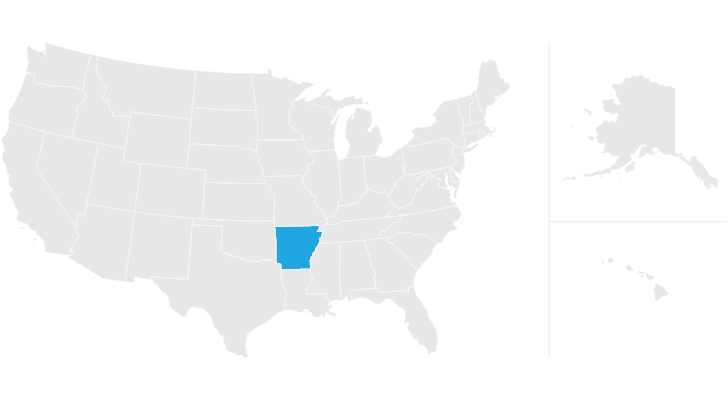

One 1 copy of the approved request must be attached to the. Arkansas charges a state sales tax rate of 65.

AR1000F Full Year Resident Individual Income Tax Return.

. Arkansas estate tax return. Those Arkansas estates who fall below this threshold will not owe any federal or state estate tax. Some examples of income producing assets.

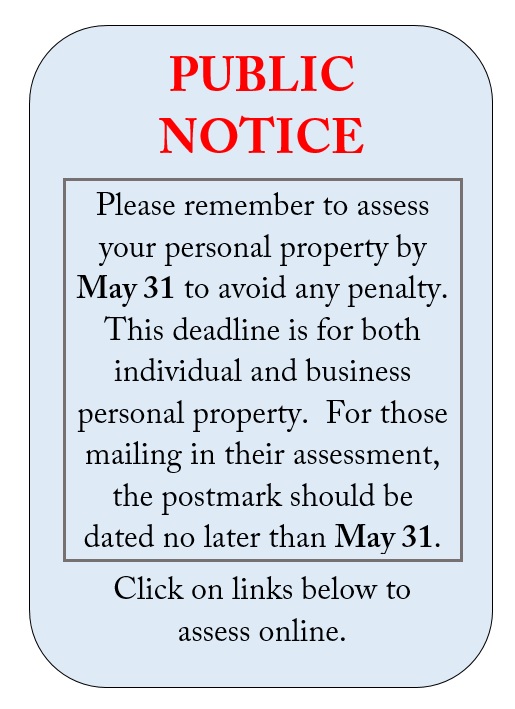

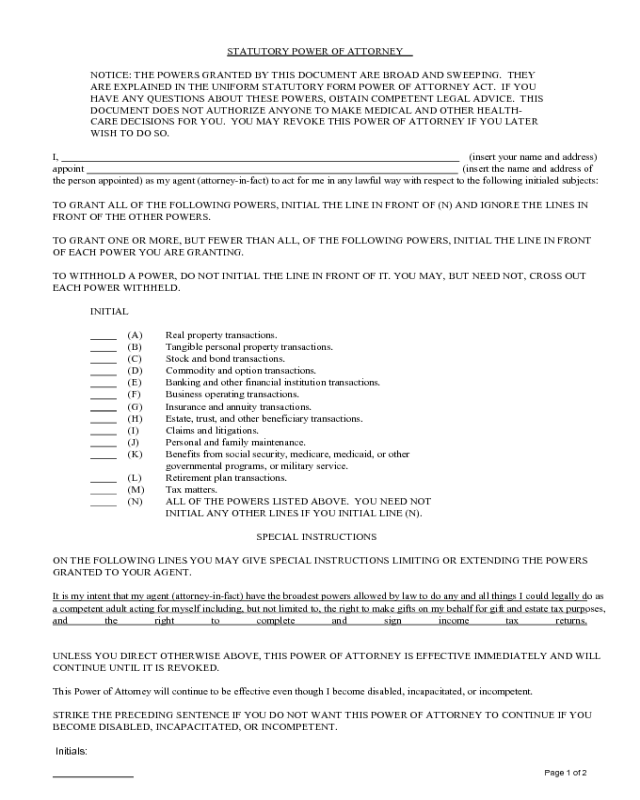

Arkansas Estate Tax Return andor Pay Estate Tax AR321E File this request in triplicate on or before the due date of the return. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc. Arkansas Income Tax Calculator.

AR1000-OD Organ Donor Donation. As with the federal deadline extension Arkansas wont charge. AR1002F Fiduciary Income Tax Return.

After filing the tax return the. Check the status of your Arkansas Income Tax return. The current tax rate is between 35 percent and 55 percent for any amount above the exemption depending on how much you have so this can amount to a significant loss of.

Arkansas Estate Tax Return. Any income the assets generate become part of the estate and may require you to file an estate income tax return. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine.

Arkansas Estate Tax Statute. A 1 Returns by Executor. For a 150000 home the buyer or.

Arkansas residents now have until July 15 2020 to file their state returns and pay any state tax they owe for 2019. Learn about arkansas income property and sales tax rates to. Property Taxes and Property Tax Rates Property Tax Rates.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due. Wwwataparkansasgov Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued. One 1 copy of the approved request must be attached to the return when filed.

Arkansas residents now have until july 15 2020 to file their state returns and pay any state tax they owe for 2019. AR1000NR Part Year or Non-Resident Individual Income Tax Return. Check your refund status at.

Go to Income Tax Refund Inquiry. In the case of resident decedents the amount of tax due the State of Arkansas is equal to the Federal Credit Allowable for State Death Taxes as determined by Table B of the United States. In all cases in which the gross estate at the death of a citizen or resident of the United States exceeds one million dollars 1000000 and a portion of the.

Tax Credits and Special Refunds TaxCreditsdfaarkansasgov. Sales Tax and Sales Tax Rates. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

The State of Arkansas is requesting additional information this filing season in an effort to combat identity tax fraud and ensure that your hard-earned tax refund goes to you. Online payments are available for most counties. The personal representative pays any claims against the estate and any taxes owed and the estate may be required to file a final income tax return.

Heirs will not be subject to an inheritance tax with the one exception noted. Documents estate tax returns and fiduciary income tax. The 2021 Arkansas State Income Tax Return forms for Tax Year 2021 Jan.

In fact only an estimated two out of every 1000 estates owe federal estate tax. Ledbetter Building 1816 W 7th Ste 2370 Little Rock AR 72201.

Freefile Program For Individual Income Tax Department Of Finance And Administration

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

Property Tax Calculator Smartasset

How Do State And Local Property Taxes Work Tax Policy Center

Arkansas Estate Tax Everything You Need To Know Smartasset

State By State Estate And Inheritance Tax Rates Everplans

Hargis And Stevens Pa Certified Public Accounts Managing Partner Resume Sample Resumehelp

Free Arkansas Lease Agreements 6 Residential Commercial Pdf Word Eforms

Statutory Power Of Attorney Arkansas Edit Fill Sign Online Handypdf

Free Arkansas Tax Power Of Attorney Form Pdf Eforms

10 Ways To Reduce Estate Taxes Findlaw

States With No Estate Tax Or Inheritance Tax Plan Where You Die

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Arkansas Property Tax Appeals Important Dates Savage Browning

Free Arkansas Tax Credit For Replacement Vehicle Bill Of Sale Pdf Eforms

Estate Tax Rates Forms For 2022 State By State Table